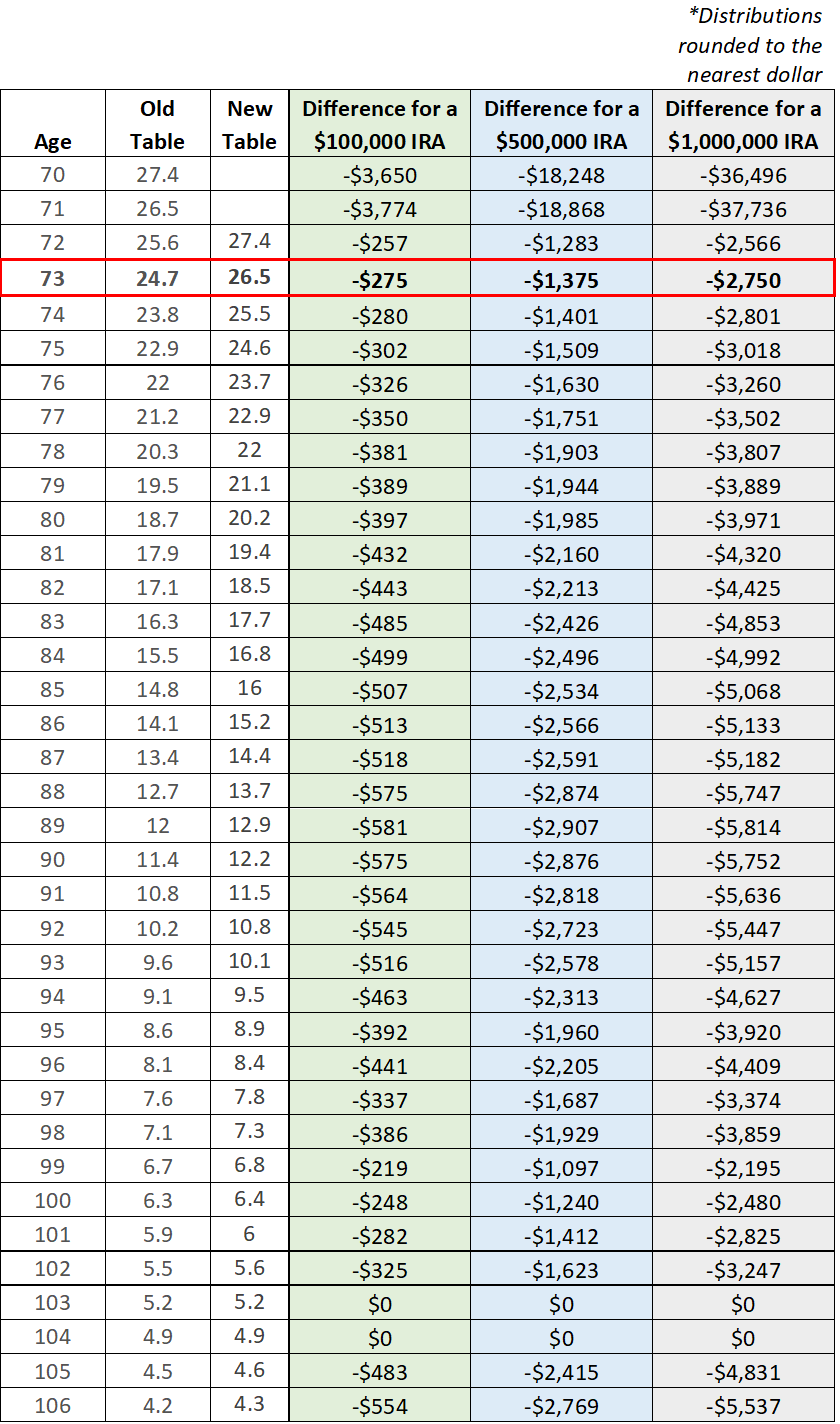

Irs Pension Interest Rates 2025 - The segment rates that apply for annuity starting dates during the period beginning october 1, 2025, and ending december 31, 2025, are the segment rates for. What Do the New IRS Life Expectancy Tables Mean to You? Glassman, The recalculation is affected by interest rates set by the irs. The irs issued a final rule on jan.

The segment rates that apply for annuity starting dates during the period beginning october 1, 2025, and ending december 31, 2025, are the segment rates for.

Interest Rates & Your Pension YouTube, Effective january 1, 2025, the limitation on the annual benefit under a defined benefit plan under section 415(b)(1)(a) of. The pension benefit guaranty corp.’s new rule, which takes effect jan.

How will rising interest rates affect our rental markets?, The irs issued a final rule on jan. By erisa news | january 16 2025.

Pension interest rates How do they work? Penfold, The segment rates that apply for annuity starting dates during the period beginning october 1, 2025, and ending december 31, 2025, are the segment rates for. Since rates right now, at the end of.

You pay tax as a percentage of your income in layers called tax brackets. The irs issued a final rule on jan.

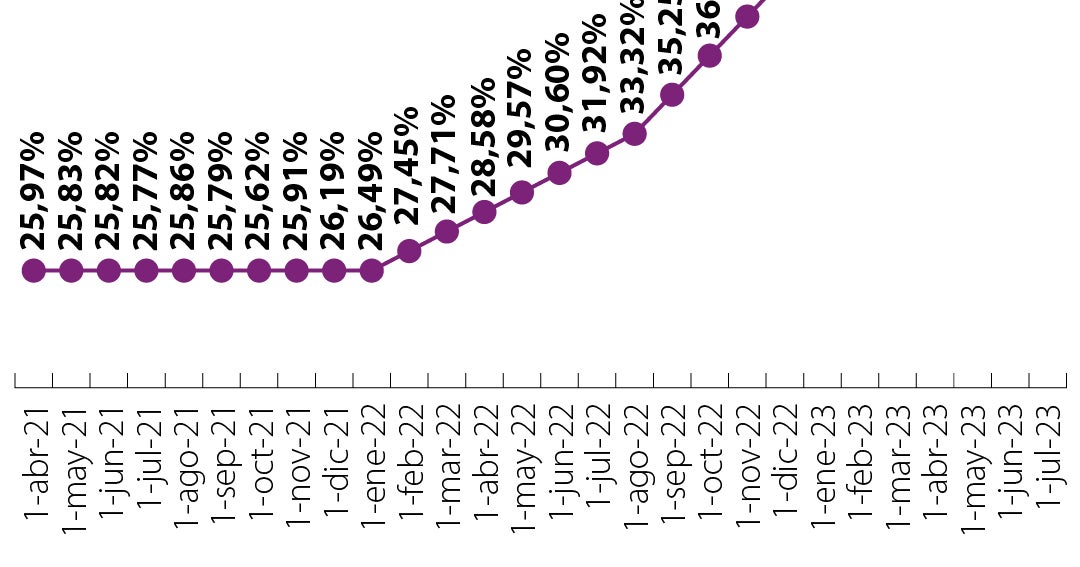

Usury Rate Falls and Credit Card Interest Rates Decrease in Colombia, The segment rates that apply for annuity starting dates during the period beginning october 1, 2025, and ending december 31, 2025, are the segment rates for. 19 to update present value calculations for pension distributions.

How Higher Interest Rates and Inflation Impact Pension Plans PNC Insights, You pay tax as a percentage of your income in layers called tax brackets. The irs issued a final rule on jan.

Irs Pension Interest Rates 2025. You pay tax as a percentage of your income in layers called tax brackets. 19 to update present value calculations for pension distributions.

A Warning To Home Buyers The Fed Just RESET Interest Rates YouTube, Update for weighted average interest rates, yield curves, and segment rates. It will apply to pension.

Pension interest rates How do they work?, Effective january 1, 2025, the limitation on the annual benefit under a defined benefit plan under section 415(b)(1)(a) of. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing.

The pension benefit guaranty corp.’s new rule, which takes effect jan.